Adopting Zero Trust Architecture for Financial Institutions: A Comprehensive Guide

Understanding the Zero Trust Architecture Framework

The Core of Zero Trust: “Never Trust, Always Verify”

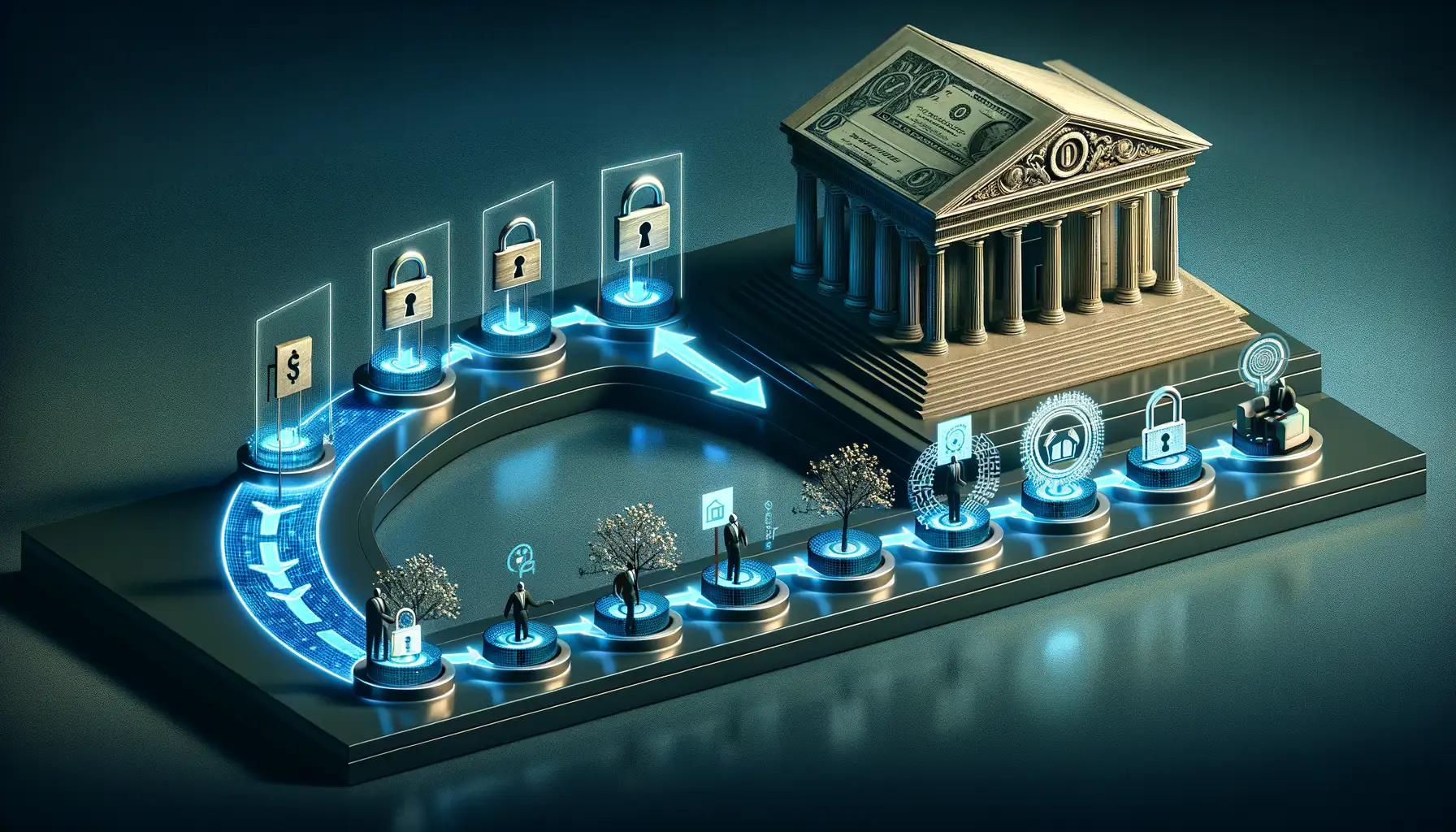

Think of the traditional castle-and-moat cybersecurity model—the walls represent the perimeter defenses, and everything inside is considered safe. But what happens when an attacker sneaks past the drawbridge? Exactly. That’s where the groundbreaking idea of Zero Trust Architecture (ZTA) comes into play.

At its heart, the Zero Trust framework flips the old script. Instead of assuming anything inside your network is inherently trustworthy, ZTA assumes the opposite. In this model, every user, device, application, or connection must prove its legitimacy—even if it’s already “inside.”

For example, imagine a financial institution with thousands of endpoints—workstations, servers, mobile devices. Without Zero Trust, unauthorized access could spread like wildfire. But with ZTA, every interaction demands authentication and validation, ensuring even internal movements are tightly controlled.

Key Components of Zero Trust Framework

Understanding ZTA means grasping its essential pillars:

- Least Privilege Access: Users and devices only get access to what they absolutely need—and nothing more.

- Micro-Segmentation: Think of your network as divided into smaller safes. Each safe operates independently, limiting damage if breached.

- Continuous Monitoring: It’s not set-it-and-forget-it. Every access attempt is scrutinized in real-time.

- Identity-Centric Security: Who someone is matters more than where they’re connecting from. Authentication reigns supreme.

- Threat Intelligence: Using data-driven insights to proactively identify vulnerabilities and intrusions.

The beauty of Zero Trust is its adaptability. Whether you’re a global bank or a local credit union, it scales to fit your needs while relentlessly keeping threats at bay.

Why Zero Trust is Critical for Financial Institutions

Protecting Your Financial Fortress with Zero Trust

Picture your financial institution as a massive, heavily guarded fortress. Sounds safe, right? But what if the enemy isn’t outside the gates? What if they’re already inside—disguised, lurking, waiting to strike? That’s precisely why adopting a Zero Trust Architecture is non-negotiable for today’s financial institutions.

The stakes couldn’t be higher. Banks, insurance companies, and asset managers are prime targets for cybercriminals. Data breaches don’t just steal sensitive information—they obliterate trust, driving away customers faster than you can say “insufficient security.”

With Zero Trust, the old “trust but verify” mindset is replaced with “never trust, always verify.” Every user, device, or application must prove its legitimacy, no matter how familiar they seem. Think of it as asking for ID every single time someone enters a room in your fortress—even if they’ve been living there for years.

- Insider threats: Employees and contractors, intentionally or accidentally, are among the biggest risks.

- Phishing and malware: A single wrong click can snowball into catastrophic breaches.

- Regulatory compliance: Many legal frameworks now demand tighter security postures.

Every entry point is a potential vulnerability, whether it’s an employee logging in remotely or a vendor accessing shared files. With Zero Trust, you shut down these vulnerabilities before they have a chance to become headlines.

Steps to Implement Zero Trust in Financial Sectors

Build the Foundation with Identity Verification

In the financial world, trust is earned one step at a time—and for Zero Trust, it starts with identity verification. Every user, every device, and yes, every app attempting to access sensitive data must first prove it’s trustworthy. The days of “log in once and you’re good to go” are gone. Implement Multi-Factor Authentication (MFA)

Once inside the system, Zero Trust treats every data packet like a crown jewel. Encryption becomes your dearest ally. Whether data is being sent, received, or stored, ensure it’s wrapped up tightly in encryption protocols. Think of it as locking sensitive information in an unbreakable safe—even if someone sneaks in, they can’t open the prize. And don’t forget segmentation! Divide your network into smaller, isolated pockets. It’s like creating fireproof barriers in a building; if a breach happens, it won’t spread like wildfire. Combine that with real-time analytics, and you’ll know the second something isn’t right—like a digital burglar alarm for your financial fortress. Adopting a Zero Trust architecture can sometimes feel like trying to solve a thousand-piece puzzle in dim light. Financial institutions often grapple with challenges that aren’t just technical—they’re cultural and operational too. For example, legacy systems that have been patched together over decades? They don’t play nice with modern security principles. And let’s not forget the human side—convincing teams to pivot from implicit trust to “verify everything” can spark resistance and misunderstanding. Here’s where things can unravel: Every institution’s journey is unique, but smart fixes exist. Start small: pilot the Zero Trust framework in a controlled environment before scaling up. Leverage layered solutions like multi-factor authentication (MFA) and micro-segmentation. They’re like turning on flashlights in that dimly lit puzzle room—suddenly the pieces start fitting. For cultural hurdles, put people first. Educate teams on how these measures safeguard customer trust and sensitive data. Sprinkle in success stories; paint pictures they can relate to. And invest in automation tools that reduce manual workload, ensuring efficiency without burning out your IT cavalry. When the path feels steep, remind yourself why this matters: a truly resilient defense of what matters most—your customers’ financial futures. Picture this: a world where cybersecurity doesn’t just defend but predicts. That’s the future powered by AI and Machine Learning (ML). These technologies are stepping into the spotlight, revolutionizing how financial institutions detect and respond to threats. Think of them as tireless sentinels, analyzing millions of data points in real time to sniff out suspicious activity before it spirals into chaos. For instance, AI can identify unusual login patterns—like a New York-based banker suddenly “logging in” from a café in Tokyo—and immediately flag or block the attempt. What’s more, machine learning algorithms will continuously adapt to emerging threats, much like learning from past battles to sharpen their defenses. The era of static security is over. Instead, expect to see systems that practically think for themselves, elevating protection to a whole new level. When you think of blockchain, your mind might jump straight to cryptocurrencies like Bitcoin—but here’s the twist: its potential goes far beyond digital coins. For financial institutions, blockchain could be the ultimate weapon against cyber threats. Why? Its decentralized nature makes it practically tamper-proof—no single point of failure means hackers can’t hit “delete” on your most sensitive data. Imagine audit trails that are set in stone. Blockchain ensures every transaction or modification is logged immutably, creating an ironclad chain of custody for data. This spells great news for compliance too, as regulators increasingly demand transparency. And we’re only scratching the surface. Expect blockchain-based identity verification to rise, reducing reliance on easily-compromised passwords. In tomorrow’s world, you won’t just bank on blockchain—you’ll trust it with your institution’s very survival.Shield Data Like It’s Your Most Precious Asset

Challenges and Solutions in Zero Trust Adoption

Untangling the Complexity of Zero Trust Implementation

Tailored Strategies: From Chaos to Control

Future Trends in Cybersecurity for Financial Institutions

AI and Machine Learning: The Cyber Guardians of Tomorrow

Blockchain Technology: Beyond Transactions